🤖 CYBER WEEK SPECIALS: Save Huge on All Courses NOW: Claim Here 👈

Holiday Special: Get 50% OFF your First 3 Months of Master Your Money™ now through 12/29: Claim Here 🎉

ATTENTION FUTURE money MASTER…

Do you know where your financial health is at?

Take our updated quiz and get your Hammer Financial Score... no bullsh*t, just the tough love check you KNOW you need.

Over 2M+ quiz takers, 550K+ YouTube subscribers, and thousands who finally stopped guessing, and mastered their money.

Welcome to Financial Audit: The Show Where Your Finances Get Roasted and Rescued.

Every week, Caleb sits down with someone whose finances are… let’s say “a work in progress.”

You’ll laugh, you’ll cringe, you might even see yourself in their numbers, and you’ll leave with real, actionable steps to fix your own money mess.

This isn’t boring spreadsheet talk. This is raw, real, and sometimes ridiculous… but it works.

Are You a Financial Dumpster Fire?

Get in the Hot Seat… and Fix Your Monies.

If you’re afraid to check your bank account… if you’ve got a “WTF?” money story… or if you just need Caleb to slap you across the face with some no-nonsense financial tough love — we’re looking for you.

Come on the show, spill the tea, and walk away with a game plan that could change your life (or at least your credit score).

Need a hand?

Caleb's Personal Finance Wisdom Could Change Your Life...

Financial Audit

(YouTube Show)

Real people. Real money problems. Real solutions.

Financial Education

Simple, straight-talk lessons to get you out of debt and building wealth without living off instant ramen.

Newsletter

No spam. Just quick, smart, sarcastic money advice in your inbox.

Trusted By Thousands Who Finally Paid Off Debt and Mastered Their Money

Here’s How Caleb Fixes Your Financial Mess…

Take Control of Your Personal Finances

Know your numbers, kill the guesswork, and stop overdrafting like it’s a hobby.

Build a Bulletproof Budget

One you’ll actually stick to (yes, really).

Avoid “Walmart Floor” Moments

Because passing out in public over money stress isn’t a good look.

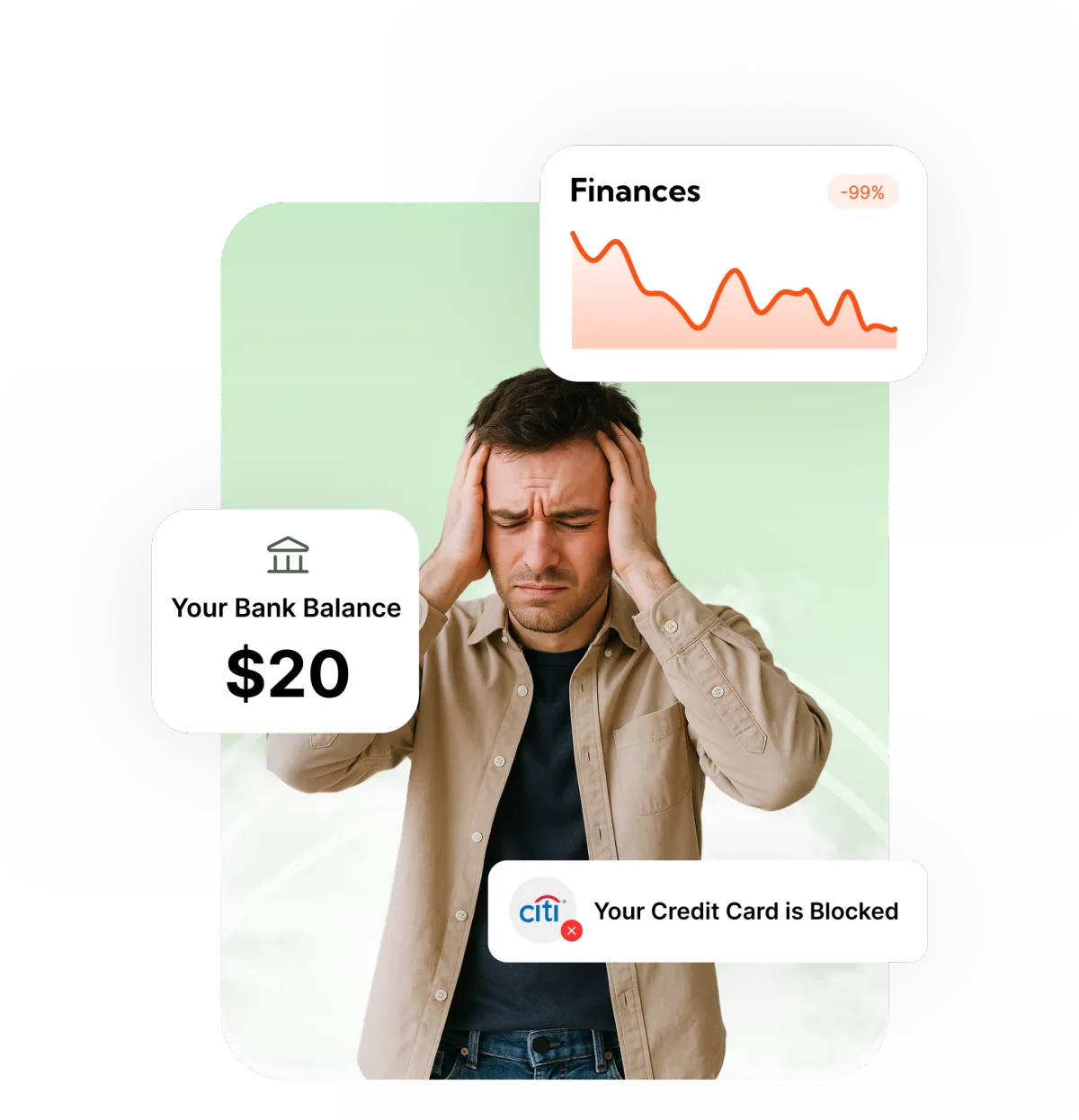

Does This Sound Familiar?

You’re scared to check your bank account...

You're working your ass off but somehow always broke by the end of the month.

You want to save money, but budgeting makes you feel like you’re back in math class.

Your friends are posting about their "investments" and "emergency funds" while you're over here Googling "how to make $20 last until payday" at 2 AM.

You feel behind, ashamed, and honestly? A little pissed off nobody ever taught you this stuff.

School taught you all about Shakespeare but not how to avoid overdraft fees. While your parents are either secretive or STRESSED.

Here's the truth:

You're not failing because you're bad with money. You're failing because you were never given the tools to succeed.

Who is this guy, anyway?

Caleb Hammer started out like a lot of people — deep in debt, maxing out credit cards on fast-food delivery, and wondering why his bank account hated him.

Then he got obsessed with learning how money actually works… and made it his mission to drag as many people as possible out of their own financial dumpster-fires.

Now, through Financial Audit, resources, and education, he’s helped millions stop winging it with their money and start building something real.

Want More Caleb?

Join hammer Elite — The Membership for Hardcore Financial Audit Fans.

2 Exclusive Shows Every Weekday

Member-Only Live Streams

Custom Emojis & Loyalty Badges

Exclusive behind-the-scenes episodes & Q&A

Private Community Access

Your Money Won’t Fix Itself. Take the First Step.

Start with the quiz. End with a life that doesn’t involve a panic attack every time you check your account balance.

Over 2M+ quiz takers, 550K+ YouTube subscribers, and thousands who finally stopped guessing, and mastered their money.

The Proof Is In The Pudding

There's a reason why students keep coming back...

COMPANY

CUSTOMER CARE

CUSTOMER CARE

NEWS

LEGAL

© Copyright 2025. Hammer Media. All Rights Reserved.