- The Ultimate Guide for Recession Survival

Everything You Need to Stay Employed, Protect Your Income, and Navigate a Recession with Confidence

- In-Depth Recession Survival Course

- Step-by-Step Income Protection & Growth Plan

- Inflation-Focused Budgeting & Investment Tools

The Ultimate Guide for Recession Survival

Everything you need to protect your income, outsmart inflation, and finally feel in control—say goodbye to financial stress

For Just $97

In-depth Modules to Recession-Proof Your Life

From understanding inflation and layoffs to growing your income and making smarter money moves. No jargon, just actionable strategies that actually work in the real world.

A Practical Plan to Protect Your Income

This isn’t theory. You’ll get a step-by-step plan designed to help you stay employed, earn more, and stretch every dollar. This course is built for today’s economy, not the one we wish we had.

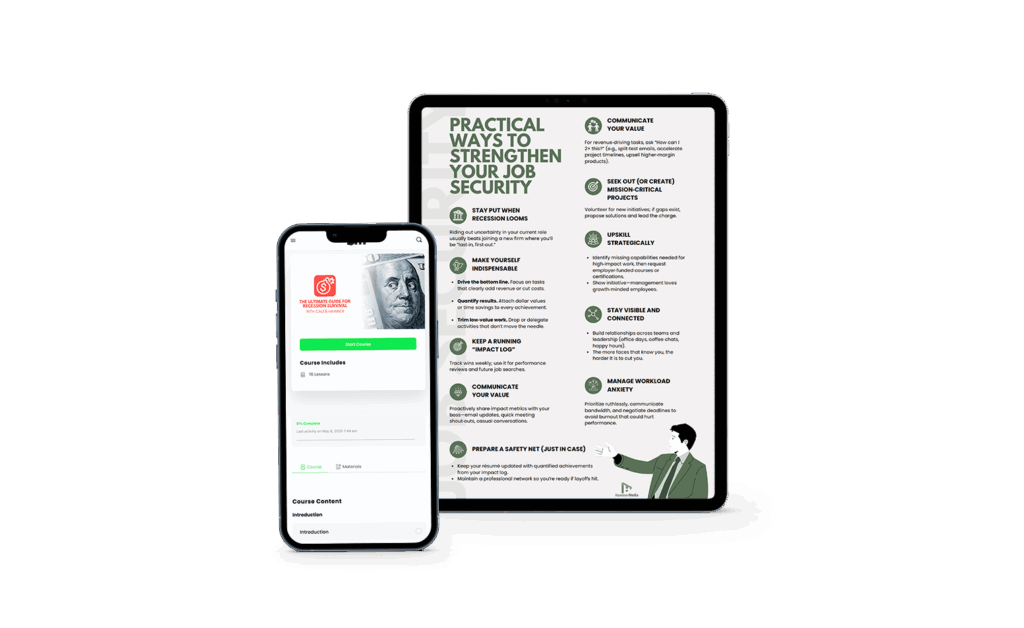

Tools to Survive (and Thrive) in a Downturn

Get access to job security checklists, side hustle planners, inflation-adjusted budgets, and decision-making tools that help you stay calm, prepared, and ahead of the curve.

Are You Worried About the Economy Right Now?

Are you seeing prices rise while your paycheck stays the same? Wondering if your job is next on the chopping block? Are you trying to figure out how to make your money last when everything suddenly costs more?

If so… we’ll help you eliminate your worries starting today.

Inside this course, we break down real, practical strategies for surviving and thriving in a recession.

We cover how to protect your job, grow your income on the side, invest without fear, and build a flexible plan that works—whether inflation stays high or the downturn drags on.

You’ll learn how to cut the right costs, not just everything you enjoy.

These moves could protect thousands—if not tens of thousands—of dollars in income, savings, and opportunities over time.

Finally Feel Confident About Your Financial Future

We built this course to give you every tool, strategy, and step-by-step plan you need to feel confident during uncertain times. If something’s missing or changes with the economy, we’ll update the course—your feedback matters.

We know everyone’s situation is different. Whether you’re worried about layoffs, navigating rising prices, or trying to protect what you’ve built—we’ve got you covered. This course meets you where you’re at, and gives you a real plan forward.

We didn’t hold anything back. At $97, you’ll get a complete system to recession-proof your life—no hidden upsells, no fluff, just the strategy.

And there’s no expiration. Once you join, the course is yours for life. Any updates we make? You’ll get those free, too.

See what everyone is saying...

What You'll Learn

You will learn how to prepare, protect, and grow your wealth, no matter what the economy throws at you. We walk you through step by step how to grow your wealth in economic mayhem and also prepare you for the future regardless of where you are in your economic journey.

Understanding the Storm

Gain a clear understanding of the historical causes of recessions so you can rise above the panic and focus on practical ways to protect your job, grow your savings, and stay on track for long-term financial success.

Protect Your Paycheck

Learn which jobs are most at risk during a recession and how to stand out as a valuable asset to protect your paycheck.

Make More Money—Even When Jobs Are Scarce

We’ll show you how to turn your existing skills into extra income streams and pursue certifications with high returns on investment, even in a tight job market.

Recession Budgeting

Learn how to build a recession-proof budget, stretch every dollar, and prepare your finances for the toughest economic conditions.

Investing in Uncertain Times

Master smart investing strategies during a downturn. We’ll cover market timing, dollar-cost averaging, and which sectors tend to perform best during inflation and economic instability.

Protecting What You’ve Already Built

Find out which insurance policies need a second look, how to avoid scams and risky loans, and get practical strategies to lower your bills, reduce interest rates, and safeguard your financial foundation.

Enroll Today

- 4 Tactical Modules to Outsmart a Recession

- How to Navigate a Tough Job Market

- Build a Recession-Proof Budget

- Invest with Confidence, Even in a Downturn

- Step-by-Step 30-Day Action Plan

- Free Access to All Future Course Updates

- 30-Day Money Back Guarantee

-

Your Price $147

Enroll Today For The Ultimate Guide for Recession Survival

Everything you need to protect your income, outsmart inflation, and finally feel in control—say goodbye to financial stress

-

Your Price $147

- 5 Full Courses

- New Courses Every Quarter

- Tools, Templates and Guidance

- Budgeting App Access

Learn to take control of your finances during the recession and enroll today!

It’s time to actually take steps to protect your income, outsmart inflation, and finally feel in control. Click below to enroll now and get instant access.

Still have questions?

Signing up for the class will get you access to our exclusive support email!

Don’t worry we have a 30 day money back guarantee.

We see this course as an investment. We wanted to make sure there was no doubt that this course could provide you with enough value.

Yes. As we get feedback from class purchasers and as new information comes out, we will keep this class updated. All updates will be free.

Yes! This class works for those not in the U.S. as well. We teach you how to think critically about your financial situation and make changes based on your specific situation.

$147

- 30-Day Money Back Guarantee